Non-Conundrum of the Prius Fallacy

Written by:

Shakeb Afsah and

Kendyl Salcito • Mar 26, 2012

Topic: energy efficiency; energy rebound

This is the most recent in CO2Scorecard’s ongoing analytical series on Energy Rebound and its misplaced centrality in the climate change discussion. For previous research notes on the topic, please click here and here.

Corresponding author: Kendyl.Salcito@CO2Scorecard.org

There is a new term circulating to suggest that by choosing fuel-efficient and low-energy consumption technologies we actually end up increasing our energy use and CO2 emissions. The “Prius Fallacy” is now the catchphrase for the uselessness of energy efficiency that David Owen of The New Yorker has pitched in the pages of the Wall Street Journal and amplified as the central theme in his recent book Conundrum. Owen has disseminated his claims on the opinion pages of the New York Times, and the catchphrase has over 4,000 hits on Google within two months after its invention.

There is a new term circulating to suggest that by choosing fuel-efficient and low-energy consumption technologies we actually end up increasing our energy use and CO2 emissions. The “Prius Fallacy” is now the catchphrase for the uselessness of energy efficiency that David Owen of The New Yorker has pitched in the pages of the Wall Street Journal and amplified as the central theme in his recent book Conundrum. Owen has disseminated his claims on the opinion pages of the New York Times, and the catchphrase has over 4,000 hits on Google within two months after its invention.

We have detailed the empirical flaws in Rebound repeatedly (see the links above) but have not directly tackled the metaphor itself.

The Prius Fallacy rests on two key assumptions: (1) that Prius drivers drive more because they are paying less in gas, and/or (2) that Prius drivers use money saved on fuel to purchase or participate in energy- & carbon-intensive goods and activities.

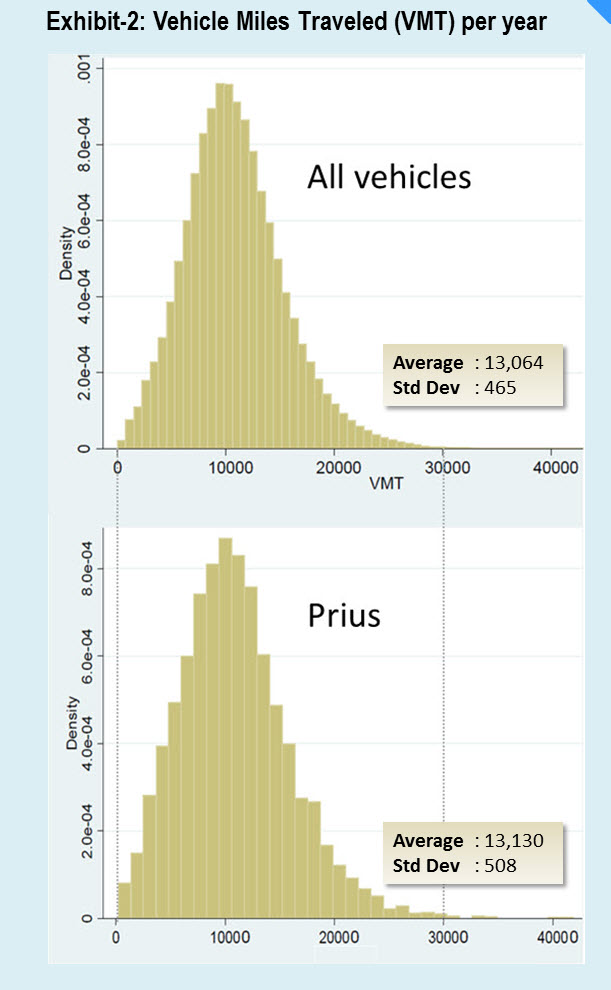

To address the first assumption we turned to the work of Professor Ken Gillingham of Yale University. Prof. Gillingham meticulously compiled a micro-dataset on personal automobiles for his doctoral research at Stanford. This dataset contains information on personal vehicle registration from automotive data supplier R.L. Polk and actual odometer readings reported by the California Bureau of Automotive Repair, who conduct emissions tests. At our request he matched Vehicle Identification Numbers (VINs) to compare the distribution of vehicle miles traveled (VMT) for a sample of 4,208 Prius owners and around 4.6 million other automobile drivers in California.

To address the first assumption we turned to the work of Professor Ken Gillingham of Yale University. Prof. Gillingham meticulously compiled a micro-dataset on personal automobiles for his doctoral research at Stanford. This dataset contains information on personal vehicle registration from automotive data supplier R.L. Polk and actual odometer readings reported by the California Bureau of Automotive Repair, who conduct emissions tests. At our request he matched Vehicle Identification Numbers (VINs) to compare the distribution of vehicle miles traveled (VMT) for a sample of 4,208 Prius owners and around 4.6 million other automobile drivers in California.

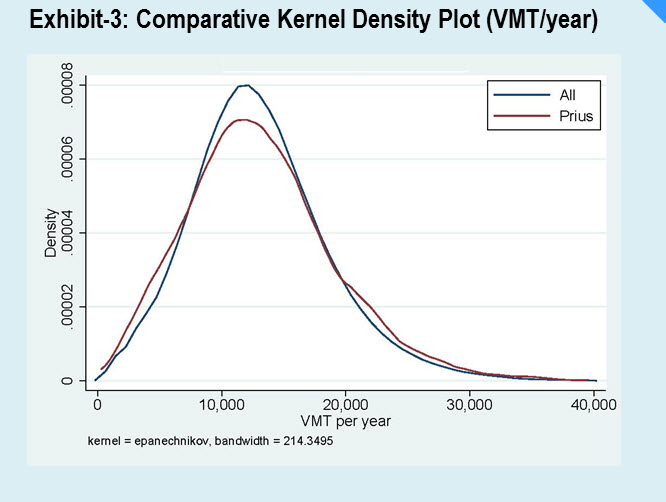

The result obliterates the Prius Fallacy’s first assumption. As shown in the comparative histogram in Exhibit-2, there is no difference in VMT by Prius owners and the rest of California’s drivers. On average Prius owners drove 13,130 VMT/year compared to 13,064 VMT/year for non-Prius owners—a difference of a mere 0.5%. The similarity of the VMT profiles of Prius and non-Prius is confirmed statistically and visually in the overlapping kernel density plot shown in Exhibit-3 (see endnote on data and diagnostic regression). This finding is in line with the simple economic logic produced by Prof. Matthew Kahn of UCLA at the Christian Science Monitor.

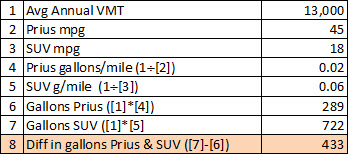

When consumers switch from conventional cars to a fuel-efficient hybrid like a Prius which gives 45 miles to a gallon, there is a genuine reduction in the consumption of gasoline - up to 430 gallons per year for an owner who switches from an SUV—an 18-mile-a-gallon vehicle (based on average 13,000 VMT/year).

When consumers switch from conventional cars to a fuel-efficient hybrid like a Prius which gives 45 miles to a gallon, there is a genuine reduction in the consumption of gasoline - up to 430 gallons per year for an owner who switches from an SUV—an 18-mile-a-gallon vehicle (based on average 13,000 VMT/year).

To understand the significance of 430 gallons (~10 barrels) consider that the US imported roughly 600,000 barrels of gasoline every day in March 2012 (EIA). If around 60,000 people replaced their cars with hybrids, we would eliminate a full day of gasoline import in the course of a single year. If 25 million people replaced their SUVs/trucks and other low mileage passenger cars with hybrids (from America’s ~200 million registered vehicles), we could eliminate gasoline imports entirely (given the import average for 2012 so far). As long as Prius drivers don’t become the world’s largest coal-consumers, it’s hard to see any catastrophic rebound here.

But what if Prius drivers do guzzle coal? This leads us to Owen’s second assumption: that money saved on fuel is spent on carbon-intensive purchases. The fact is, we don’t know how Prius drivers spend the $1500 they save on fuel each year (assuming $3.50/gallon gas prices). Some may hide it in mattresses (zero rebound), some may install solar panels (a case of negative rebound), some may use it for the down payment on a Land Rover (positive rebound). In the worst possible scenario, you can imagine a Prius owner spending all her $1500 to buy anthracite coal to grill burgers in her backyard. We haven’t found a study contrasting the purchasing habits of hybrid drivers and conventional car drivers; as such, we can only rely on the aggregate macroeconomic figures.

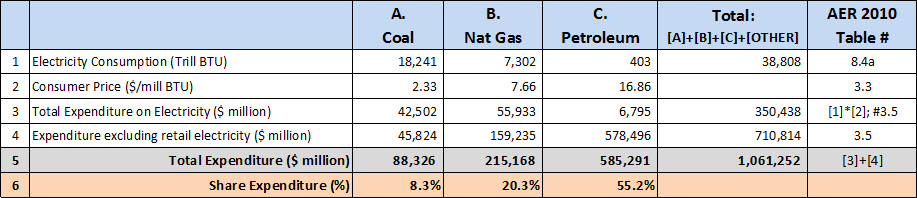

As Owen and others have pointed out, about 6-8 percent of the US GDP is spent on energy in a given year. This 6-8% share of the GDP accounts for the total energy we consume—including items like the direct gasoline we buy, the electricity we consume at home, and the indirect or embodied energy used in the production of our cars, dishwashers, etc. The 6-8% share accounts for our aggregate spending behavior—the dollars we directly and indirectly spend on energy consumption.

We expect that an average Prius owner will spend the extra money the same way they spend the rest of their money. In the worst case scenario, then, where 8 percent of a Prius driver’s $1500 fuel savings is spent on energy $120 ($1500*8%) is re-injected into the energy economy. But only 8.3% of the energy expenditure in the US economy is associated with coal—the fossil fuel of most concern (see data and statistical endnotes). Therefore $10 (8.3% of $120) or just 0.7% of the total fuel efficiency savings will rebound to generate CO2 emissions from coal.

Natural gas and petroleum account for 75.5% of energy expenditure in the US. This implies that around $91 ($120*75.5%) or 6% could rebound in the form of energy use from natural gas and petroleum. The total worst case scenario for indirect rebound associated with fossil fuel use adds up to 6.7% (0.7% + 6%).

Some rebound proponents have argued that dollar spent on energy has a two- or three-fold multiplier effect. It is hard to see how that is possible—if up to 8% of our GDP accounts for energy use, it already includes the energy component of the rest of the 92% of the GDP. Both direct and indirect energy use within the economy are included in the 8% share. Adding a two- or three-fold multiplier on top of that would lead to phantom accounting.

There is little in the way of a solid theory or verifiable empirical estimate that proves the existence of multiplier effect in this particular context. And even if we give the benefit of the doubt to the proponents of rebound and assume the existence of multiplier effect, the share of the $1500 savings will on average account for rebound worth $201 (13%) and $301 (20%) for two- and three-fold multipliers respectively.

So, at her worst, an average Prius driver is re-injecting $101-$301 of her $1500 savings into energy use from fossil fuel. And that’s near the worst-case scenario. If Prius drivers don’t drive more than conventional drivers, and if Prius drivers must (lacking evidence to the contrary) be considered among average American consumers, where’s the real fallacy?

Final Thoughts

We've written about other failed anecdotes in Owen's Rebound reporting in the past, including the fallacy that efficient refrigerators have rebound effects – more people buy side-by-side fridges as cooling food gets cheaper. As shown in our earlier research note, rising sales of energy efficient refrigerators coincided with a 3.3% total energy consumption reduction between 2001 and 2005, even as 5.2% more households invested in more than two refrigerators.

Owen's preference for narrative over fact is concerning, not just because he is informing Americans on key components of climate policy without researching the realities, but because as an established and respected staff writer at The New Yorker he is so well positioned to disseminate this simple and false storyline.

Data and Statistical Notes

A: Description of the vehicle-level dataset

- Professor Ken Gillingham’s dataset on vehicle ownership and driving behavior is an example of micro-level datasets that are most appropriate for understanding the energy rebound effect at a high-resolution level. Prof. Gillingham compiled this composite vehicle-level dataset for his doctoral research that aimed to quantify the impact of the changes in gasoline prices on consumer behavior in terms of two key effects—how much consumers drive and what vehicles consumers choose to buy.

- This dataset includes all new vehicle registrations in California from 2001-09 and all of the mandatory smog check program odometer readings for 2002-09. Including the information on demographics, prices, make, model and other variables, the full dataset has tens of millions of observations.

- We focused on the subsample of Priuses for which there was a title change, and we observed the smog check odometer reading. The analysis in this research brief compared the VMT of these Priuses first to all vehicles that had a title change and second to all vehicles. In both cases we found no evidence of the “Prius Fallacy”.

- Additionally, a diagnostic simple regression check was conducted using a dummy for the Prius and controls for demographics, the gasoline price, and economic conditions. The calculation turned out a negative coefficient on the Prius—suggesting that Prius owners may actually drive less than others with similar wealth, location, etc. This simple check was conducted only for assurance in the comparative histogram of VMTs shown in Exhibit-2.

B: Calculation of the ballpark estimate of energy expenditure by fossil fuel source (2009)

**Source: Annual Energy Review (AER) 2010, US Energy Information Agency (EIA)

**We are thankful to Jon Koomey for helping us crunch the estimates on energy expenditure.

C: Estimate of gallons saved when SUV driver switches to a Prius.

Acknowledgements

During the course of our research we have benefitted from conversations and discussions with many colleagues and friends. However, in this and the forthcoming notes, all the views, opinions and any error should be attributed solely to the authors and the CO2 Scorecard Group.

We are thankful to Ken Gillingham of Yale for analyzing the data on the Prius Fallacy issue for us, and taking the time to discuss his research on rebound. We are also very grateful to Danny Cullenward and Jon Koomey of Stanford for exchanging ideas and insights on a variety of energy efficiency and rebound issues. We also had discussions with Lucy Yueming, another Stanford researcher, whose doctoral research will be featured by us in a separate note on energy efficiency and rebound in the commercial sector. We also want to thank Anant Sudarshan of Harvard’s Kennedy School of Government for discussing his ongoing research on energy efficiency.

On the question of macro-rebound our review and discussions gave us a chance to take a closer look at the back-end data, mathematical specifications and assumptions underlying the economy-wide macro-rebound models, and their readiness for use of its estimates in policy discussions. On the Computable General Equilibrium (CGE) models we have benefitted from our discussions with Shanta Devarajan and Jean-Jacques Dethier of the World Bank. Our forthcoming research brief will shed some light on the state of the know-how on the equilibrium as well as the non-equilibrium models of macro-rebound.

We also had a chance to discuss energy efficiency issues with Skip Laitner of the American Council for Energy Efficient Economy (ACEEE) and we appreciate his willingness to share some of his original work on energy efficiency dating back to 1984. Finally our colleagues David Wheeler, Senior Fellow Emeritus at the Center for Global Development, and Thomas Sterner of University Gothenburg and the former President of the European Association of Environmental and Resource Economists, have provided their insightful comments at various stages of our research.

We are thankful to all for their valuable feedback and comments.